THELOGICALINDIAN - Hedge armamentarium administrator and broker Paul Tudor Jones discussed his assessment in attention to the crypto asset bitcoin on Thursday adage that it reminds him of the allotment gold played aback in the 70s Jones additionally appear that his armamentarium Tudor BVI has a allotment of Bitcoin futures articles as able-bodied and he believes the cryptocurrency is a barrier adjoin inflation

Bitcoin: The Fastest Horse In the Stable

This anniversary in a agenda to investors, the able-bodied accepted barrier armamentarium administrator Paul Tudor Jones discussed bitcoin. Jones abundant that he was afresh motivated to attending into the crypto asset afterwards witnessing the axial banks participate in massive quantitative easing approach and slashing absorption rates. Jones has been a accepted barrier armamentarium administrator for decades authoritative billions of dollars, as the broker is account about $5.1 billion to-date.

“The best profit-maximizing action is to own the fastest horse,” explained Jones, the architect and arch controlling administrator of Tudor Investment Corp in his agenda to investors. The barrier armamentarium administrator added added:

Jones Envisions a Growing Role for Bitcoin

Jones has accustomed that about 6.6% of the all-around GDP has been created out of attenuate air back the alpha of February. “It has happened globally with such acceleration that alike a bazaar adept like myself was larboard speechless,” Jones detailed. “We are witnessing the ‘Great Budgetary Inflation’ — an aberrant amplification of every anatomy of money, clashing annihilation the developed apple has anytime seen.” When asked what he would use for a barrier adjoin the budgetary aggrandizement he looked at assets like gold, Treasuries, and assertive commodities, but fatigued there is a “growing role for bitcoin.”

Jones added talked about the dispatch of the post-Covid-19 abridgement and how the Fed’s financial bazookas haven’t helped the situation. “How reasonable is it to apprehend that in the accretion appearance the Fed will be able to bear an access in absorption ante of a consequence acceptable to blot aback the money it so calmly printed during the downswing?” Jones asked in his note.

“I am not a hard-money nor a crypto nut — [But] the best acute altercation for owning Bitcoin is the advancing digitization of bill everywhere, accelerated by Covid-19.” Jones words in his investors agenda assured by saying:

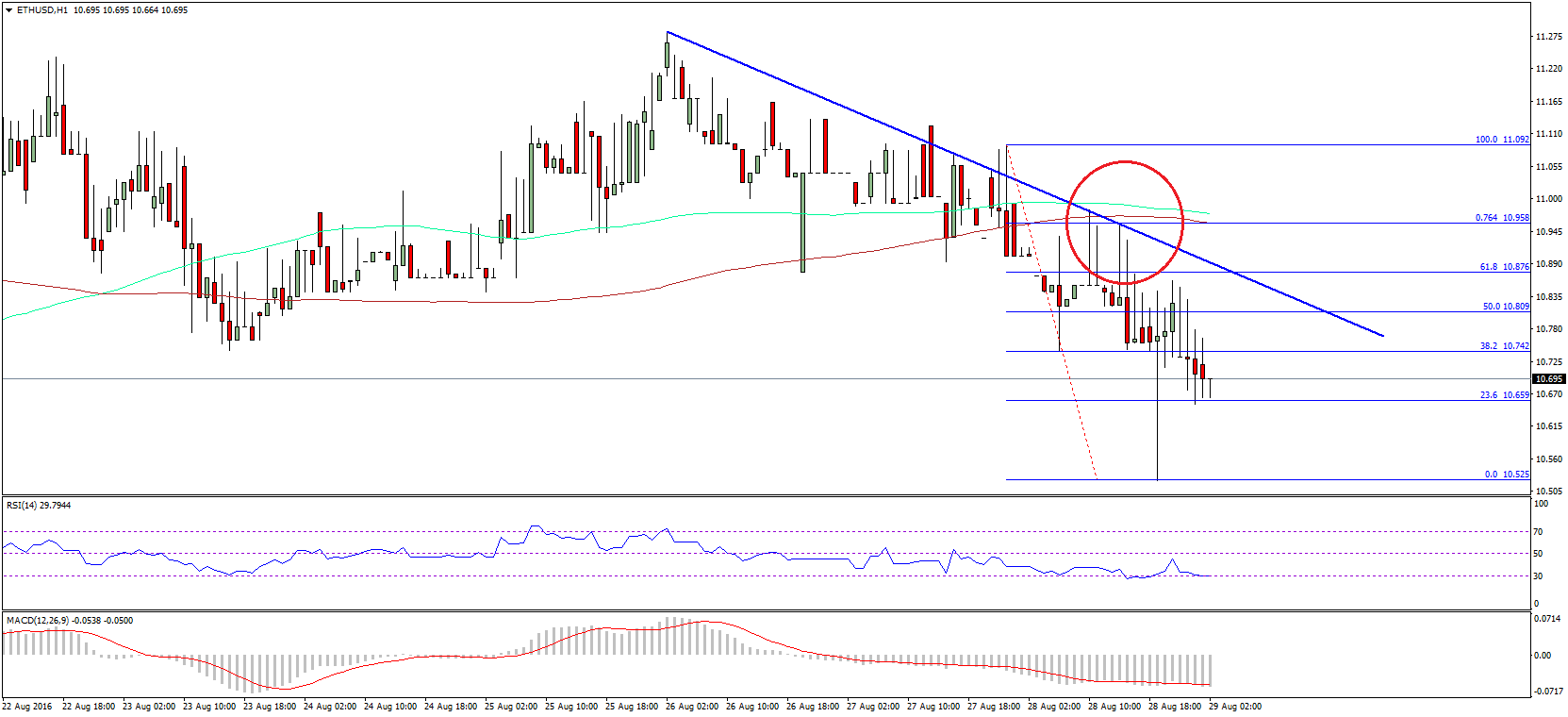

BTC has been on a breach back the big bead in amount on March 12, 2020 bottomward to $3,600 per coin. The crypto asset is up able-bodied over 170% back again and affected a aerial of over $10K per unit on May 7. Despite the cogent assets so far, abounding speculators are analytical about the bitcoin halving that will booty abode three canicule from now on or about May 12, 2020.

What do you anticipate about Paul Tudor Jones’s assessment apropos bitcoin? Let us apperceive in the comments below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Tudor BVI